It’s human nature to be extra careful when it comes to trusting an entity with finances. There is a reason why financial security is a booming industry. When it comes to regulation and financial control, cryptocurrency has always been an outlier.

The staggering rise of cryptocurrencies is fueled by its promise of eliminating third parties from financial transactions. Although in principle, this idea is revolutionary, it is still subject to turmoil in the form of fraud, theft, and cyber attacks. In 2018 alone, over 500 million USD was stolen from cryptocurrency exchanges; a figure that can rile up sentiment against the proliferation of digital currencies.

The current year is shaping up to be no different. Although the fundamentals of crypto exchange development include the administration of fortified security protocols, as technologies are progressing, so are hackers and their attempts. Amidst this context, selecting a safe cryptocurrency exchange for personal use can be a daunting task.

It is critical to have a strict evaluation criterion when delving into the world of crypto exchanges. Whether you are an entry-level investor who is brushing up on basics such as how do crypto wallets work or a more seasoned investor looking to create a fortune from trading, here are 5 metrics to consider when selecting an exchange.

Your Location and Ensuing Restrictions

Your cryptocurrency experience can only be fruitful if you are legally allowed to trade on it. Since the inception of digital currencies is relatively new and unregulated, getting a free pass to trade is essential before indulging in the market.

The vast majority of exchanges only cater to a handful of geographical locations. The availability of exchanges in a country is dependent on two things. The first is whether the service has secured legal certifications and trading licenses from relevant regulatory authorities. The other factor is country-specific; it depends on the sort of internal laws a country has regarding the blockchain and crypto.

So when the next time you are trading on an exchange, evaluate the geographical location you are trading from and the consequences it can ensue.

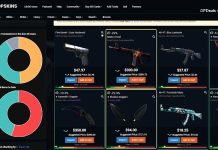

Type of Coins and Exchange Volume

Volume and liquidity are extremely critical when judging an exchange for trading viability. A large trading volume is generally considered a positive indicator for an exchange’s success since it is trusted by most users, beginners, and seasoned investors alike. Considering liquidity and volume also depends on your personal nature of trading.

This means that if you are interested in the core trading pairs such as Bitcoin and Ethereum, then your best match is to sign up for a major centralized exchange. This will grant you both liquidity and efficiency from a trading perspective.

On the other hand, if you are trading in smaller fishes, such as the ERC20 tokens then selecting an exchange with a smaller volume is better. This is because less popular projects cannot always afford the exorbitant service charges of major cryptocurrency exchanges.

Security Mechanisms

No investor wants to lose their capital. This is the exact reason why having strong security protocols is necessary for any exchange. Security should be a key factor when evaluating an exchange.

When considering mainstream exchanges with regards to volume and liquidity, they do offer traders opportunities to make a fortune. But a large trading volume also makes them the prime target for hacking and phishing attempts. After all, once hackers are in, they can quickly mobilize millions of dollars worth of digital currency in a centralized, high-volume exchange.

On the flipside, decentralized exchanges offer better security by emphasizing anonymity. On signup, people do not have to divulge private information, and there are no middlemen associated with transactions hence the risk is substantially meted out.

Types of Wallets Offered

When you make a purchase through a cryptocurrency exchange, your acquired currency is automatically stored in an exchange-hosted wallet, such as an ether hardware wallet. Usually, these wallets are custodial which means that exchanges have access to private keys.

By being the custodian of your wallet’s key, exchanges provide a seamless trading experience. When selecting an exchange, make sure you get an understanding of the type of wallets offered. Most popular exchanges invest heavily in building wallets that are both secure and efficient from a trading perspective.