Keeping track of your company’s taxes is one of your most critical obligations as a small business owner. Using a competent online tax software system, you can file your small business’s taxes quarterly or annually in a timely and precise manner. The best alternatives offer simple interfaces, extensive filing systems, and are reasonably priced.

We looked at roughly two dozen different online tax solutions and chose four from that first list. There is an online tax solution that meets your small business’s demands and budget, ranging from free small business solutions to high-end software for tax preparation specialists.

What is tax software for small businesses?

Tax software for small businesses is a web-based, desktop, or mobile business that allows you to complete your taxes without paying a professional preparer. Depending on the software you use, you may be able to submit Schedule C self-employment taxes or more sophisticated taxes for a partnership or corporation. While most personal tax preparation software focuses solely on Form 1040, small business tax software can prepare taxes for firms of all sizes.

Which tax preparation software is the best?

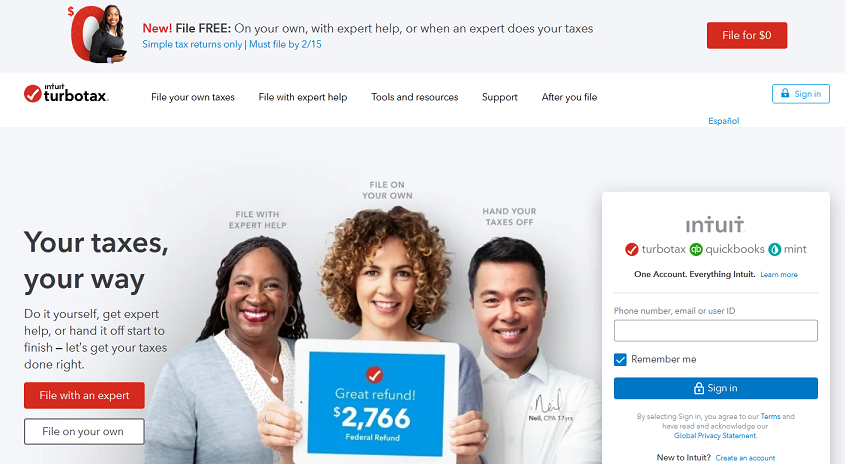

We found that Intuit TurboTax is the best overall online tax filing software on the market after conducting our analysis. Its broad features and simple design, combined with the possibility to get virtual assistance from a CPA, make it an excellent choice for most individuals and small businesses. TurboTax distinguishes itself from its competition by providing great customer support to guide users through the tax filing process.

Why would you want to utilize tax software?

The two most important reasons why business owners utilize tax preparation software are speed and accuracy. Data input with tax software is as simple as scanning an existing form and having the essential information automatically entered into the appropriate spaces. What would take hours by hand now takes minutes with a computer or mobile device.

In terms of accuracy, errors or omissions can be costly to a taxpayer. Such errors can result in audits, fines, and other injunctions, such as levies against your assets. Before forwarding your documents to the IRS, tax software examines them for flaws. Most tax software also looks for deductions or credits that pertain to your tax position, which might potentially increase the amount you receive in a return.

Top 5 Best Tax Software For Small Business In 2021

In this article, you can get the Top 5 Best Tax Software For Small Business In 2021 list, which is as follows:-

1. TurboTax

While TurboTax costs somewhat more than comparable software in this category, its features, and superb customer service make it the best online tax filing alternative. For example, the highest-tier service allows business owners to search for industry-specific deductions, and the software organizes employee tax filings.

TurboTax is available for download or online use, and it is mobile device friendly, allowing you to check the status of your return while on the road. If you are subjected to an audit, TurboTax provides specialist assistance to make the procedure less stressful.

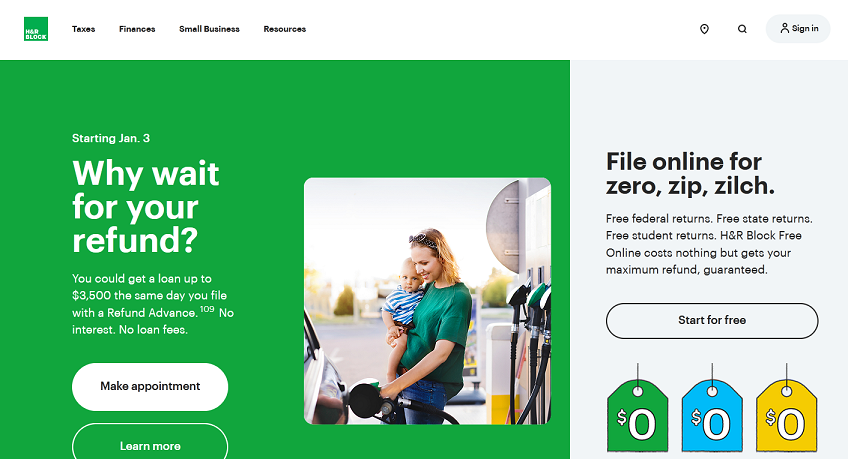

2. H&R Block

H&R Block, unlike some of its competitors, reveals its rates upfront. However, if you want a tax professional to review and sign your return, you must choose the highest tier.

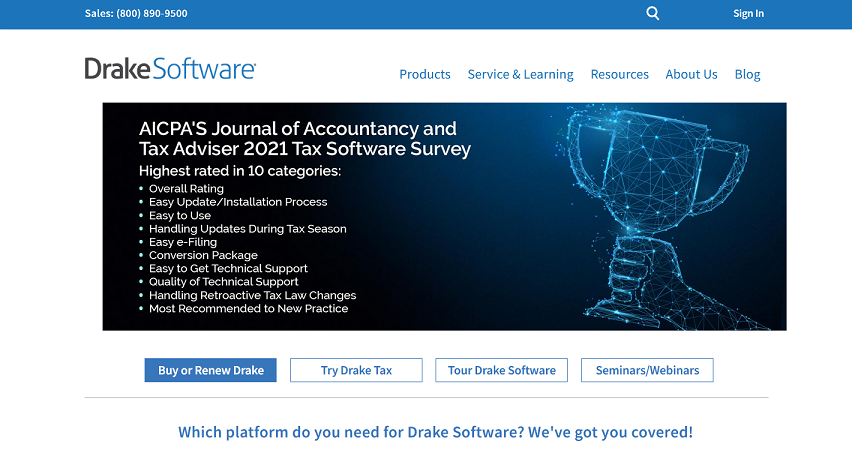

3. Drake Tax

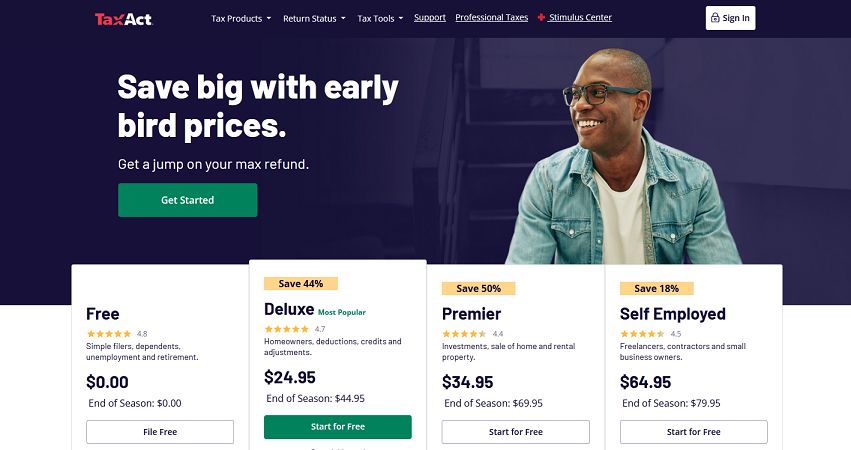

4. TaxAct

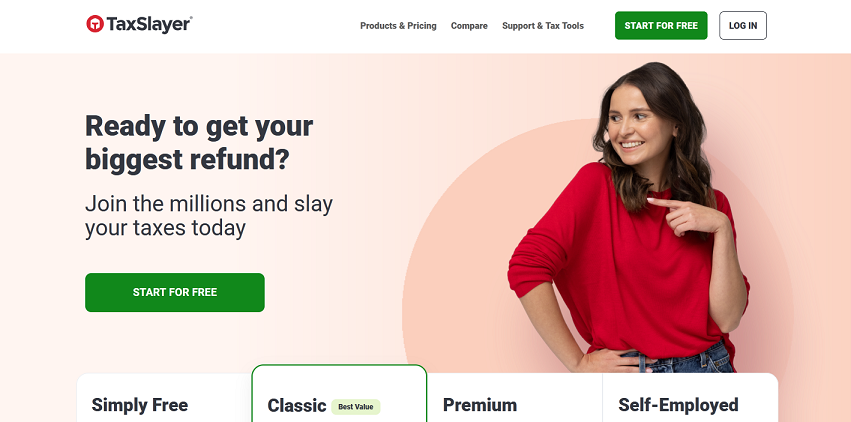

5. TaxSlayer