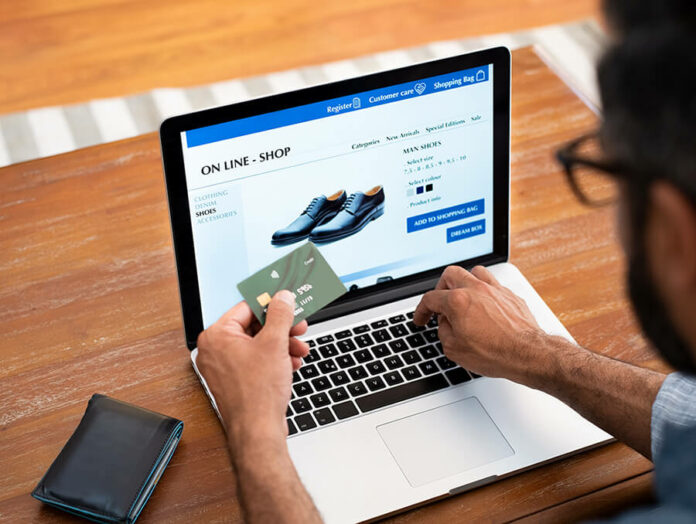

Even if you’ve never heard of payment gateways, you’ve most probably used one on average 35 times this month. Statistics definitely capture a great shift to online purchases nowadays. Every time such online purchase is made from a mobile app, it implies a transaction consisting of three parts: a buyer, an app, and a payment provider. But actually, there is also a fourth agent which accompanies the whole process as a hidden mediator between every two of the three above mentioned parts for the sake of general security.

We do not pay much attention to payment gateways, aka PGWs, since as all respectable bodyguards they tend to stay as invisible as possible. In this article, however, we’ll shed some decent amount of light on the mysterious subject of payment gateways and unveil specifics of their work and practical implementation, particularly in mobile apps.

Why Bother About a Payment Gateway

Security

If you are into e-commerce, security is your bread and butter in ensuring a smooth customer journey happily ending with a payment for a good or service you sell. The first key here is providing your clients with credible check-out options. Such options typically include popular e-commerce payment providers, such as Stripe or PayPal, along with the ability to transfer the money directly from the bank account.

But regardless of whether you’ve decided to cooperate with a physical or virtual payment provider, it will only work with your e-commerce business through the means and on the condition of a successfully installed payment gateway.

Business reputation

The security of your customers’ transactions is fundamental for the payment provider’s reputation. To this end, your reputation is another critical moment impacting a customer’s willingness to seal the deal. Financial data must be thoroughly encrypted to protect it from security threats, such as hacker interventions, via the transaction.

A payment gateway is a technology called to complete this task. PWG encrypts and tokenizes financial data under its input and then passes it to the payment provider. The transaction information travels through the Internet in complete disguises, like Mata Hari but in the code’s format.

Depending on your company size and needs, there are three PWG’s types available to pick from.

Types of Payment Gateways

PWGs vary depending on the extent of your site’s or app’s authority over the payment procedure and, especially, customer financial data.

- Hosted or Redirect Gateways. Here the PGW provider hosts a gateway. That’s why when clients push the “check-out” button, they’re redirected off-site, to the PGW’s page, where both their financial data is collected and the payment is conducted.

- Self-hosted. In this case the responsibility is partially delegated to a vendor as customer financial data is collected on site. Still, the transaction itself is processed on the gateway’s side.

- Non-hosted. The gateway is installed on the website or app directly so no redirect to other software via transaction running takes place.

Gateway effectiveness is usually enabled by considerable tech resources, which, in their turn, demand some sizable financial investments. Thus, a thorough estimation of your company and such development markers as GMV (gross merchandise value) is your best ally in choosing the payment gateway type. If your e-business is large enough to separate itself from an e-commerce platform but not quite Amazon, then hosted or self-hosted PGWs are your way to go. By contrast, being a large enterprise with an extended infrastructure, it’s reasonable to think of becoming your own payment gateway host.

How Does Payment Gateway Work On Practice

Before installing a payment gateway, it’s crucial to understand how it works. Let’s say we have a self-hosted PWG as this type is the most commonly appealed to.

- A customer browses your app and picks up goods while a payment gateway tracks and records the purchase cost with each item added to the cart.

- After pushing the “pay” button, the customer’s financial data is collected on your site, app, or the PGW’s page.

- PGW uses collected data to address a payment provider, i.e., a physical bank or e-commerce payment system.

- The payment provider authorizes the transaction, and funds are withdrawn from the user’s account and transferred to your merchandise account in a few days through (you again) the payment gateway.

What Does Integration of a Payment Gateway Imply

Now uncode the ingredients of PGW’s integration into your mobile application. The most important thing is to have a good team. -p2p payment app development.

Compliance with Security Standards

Your first step upon the app’s integration is to ensure its security with the help of an SSL certificate. SSL certification goes hand in hand with the PCI DSS compliance mandate. PCI DSS stands for Payment Card Institute Data Security Standards and provides blessing to digital subjects working with sensitive authentication data unless the latter do not get along with PCI’s requirements.

To get certified by PCI, websites and applications have to go through the line of security testing measures altogether called a penetration test. During this test vulnerabilities of the system are seeked and discovered to prevent its exposure to real hacker attacks in the field, so to speak. These tests are conducted by reputable companies that offer penetration testing services.

Merchant Account

After you’ve nailed it with a SSL certificate and your app is your fortress, it is time to approach payment providers you’d like to work with. For this purpose you should decide what merchant account type you’d like to stick to: dedicated or aggregated. Dedicated account implies that your funds are stored and processed by a payment provider individually. In contrast, an aggregated account presupposes that your money is combined with other businesses’ money.

Gateway Payment Provider

The next step is choosing a gateway payment provider. The most popular options here are PayPal,Stripe,Braintree, etc. To guide you through decision-making and help make a right choice, pay attention at the following moments:

- Countries they work with. Geographical coverage varies from provider to provider. For instance, PayPal works with 200 countries while Authorize.net only targets Canada and the US.

- The currencies they accept. For example, Braintree accepts different 130 currencies, PayPal – 25.

- Check-out integration type. Some providers have check-out integrated on an app, and some

- Pricing. Fees are normally divided into two major parts: summed up amount for all transactions made for the period implied by a subscription (including international ones), and a fee paid per each transaction which depends on the currency used.

- Payout period. On average it takes from 2 to 7 days to transfer the funds to your business’ bank account.

- Security measures. You should check whether the provider you’re considering ensures built-in fraud protection.

- Customer Support. Last but not least, a feature to look for in this case is an easily reachable support service.

Additionally, with the help of a developer team proficient at P2P payment app development, you can become your own payment gateway provider.

SDK

This is a technical part implying direct integration of the payment gateway into your mobile application. As a rule, it mostly implies using a Software Development Kit (SDK) to ensure a smooth payment gateway’s implementation into your app’s software. SDK is basically a 3D manual for developers containing all tech solutions necessary to adjust the payment gateway’s code to the recipient software code.

API, which also quite often goes with the kit, is a tool specifically tailored to customize the PGW’s interface.

Payment gateways unite e-businesses with customers, ensuring solid interaction security on both sides. Thus, integrating a payment gateway is an imperious requirement that mobile applications need to meet in 2022.

Author’s bio

My name is Katherine Orekhova and I am a technical writer at Cleveroad – mobile app development company. I’m keen on technology and innovations. My passion is to tell people about the latest tech trends in the world of IT