The foreign exchange (forex) market is an expansive and dynamic financial arena, marked by its high liquidity and continuous trading opportunities. The centerpiece – the premier trading platform – for many stakeholders in this market is the MetaTrader 4 Account, known for its comprehensive trading tools, advanced charting & analytical features.

MT4 Account: A Gateway to Forex Trading

The MT4 platform is the cornerstone of forex trading, offering a range of features that cater to both novice and experienced traders alike.

- Comprehensive Tools: MT4 provides real-time market data, analytical tools, and automated trading capabilities. These features enable traders to analyze markets, make informed decisions, and execute trades efficiently.

- Customization and Flexibility: One of MT4’s strengths is its customizability. Traders can tailor the platform to their specific trading styles and preferences, making it a versatile tool for various trading strategies.

- Global Accessibility: In today’s interconnected world, global accessibility is crucial. MT4 allows traders to access the market from anywhere, at any time, which is essential for keeping pace with the constantly evolving forex market.

Forex Market Dynamics: A Deeper Look

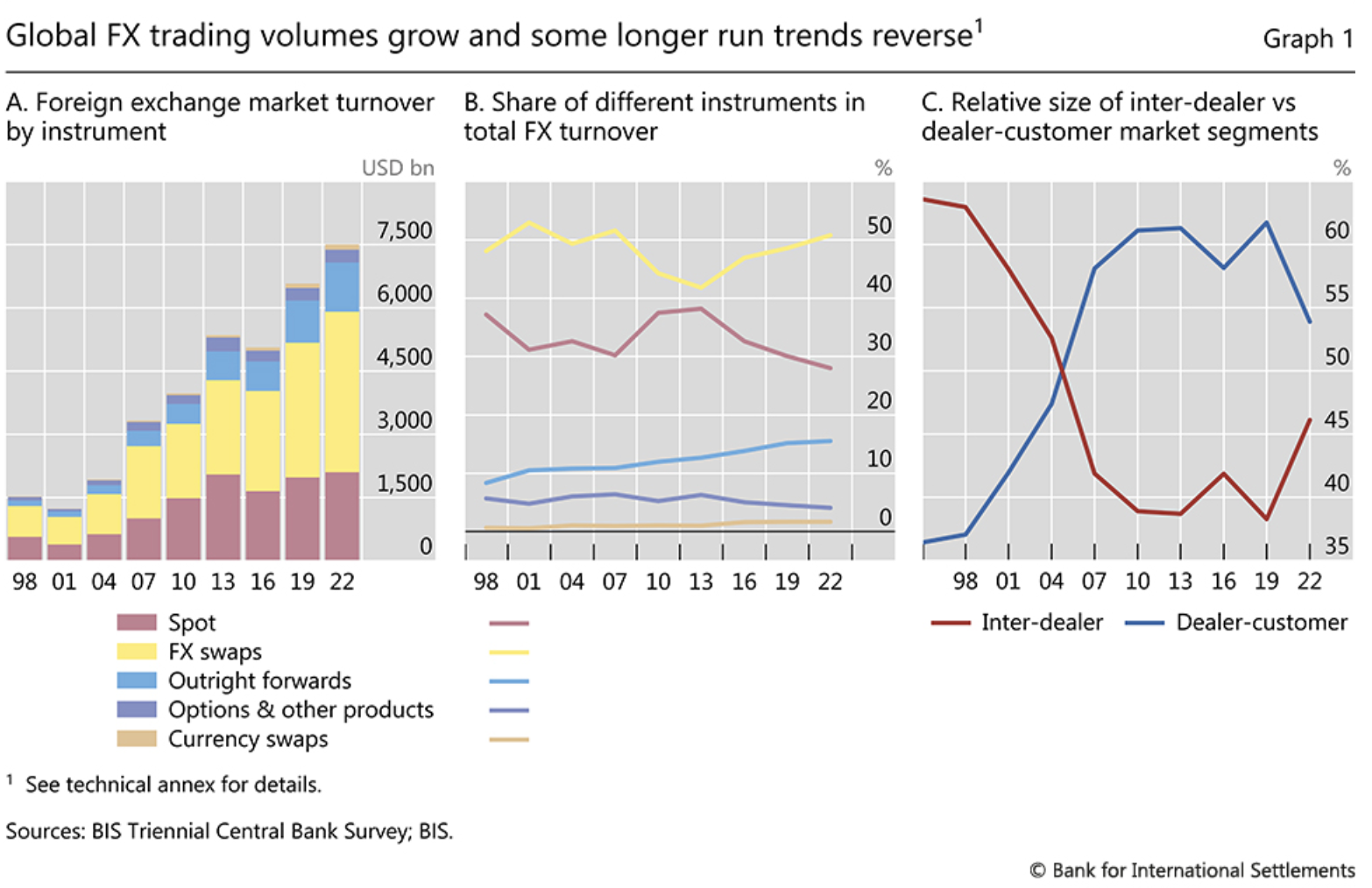

Recall the forex market’s daily turnover of $7.5 trillion in April 2022 reflects a significant increase from previous years. This growth is driven by heightened volatility and changing market dynamics, influenced by several key factors:

- Geopolitical Tensions: Events such as Russia’s invasion of Ukraine, Israel/Hamas, and sabre rattling elsewhere have created uncertainty, leading to increased market volatility. Such geopolitical developments often result in rapid currency value fluctuations, making accurate and timely information more crucial than ever.

- Interest Rate Fluctuations: Changes in interest rates by major central banks significantly impact currency values. Traders need to stay informed about these changes to predict currency movements accurately.

- Commodity Price Changes: Fluctuations in commodity prices, such as oil, can have a profound impact on currencies, especially those heavily reliant on commodity exports.

Key Features of the Forex Market

The forex market is characterized by its global reach, continuous operation, and sensitivity to a wide range of factors:

- Global Reach: The forex market involves a diverse range of participants, including banks, corporations, and individual traders, each contributing to its depth and liquidity.

- 24/7 Operation: Unlike other financial markets, forex operates continuously, providing constant trading opportunities across different time zones.

- Influenced by Global Events: The forex market is significantly impacted by economic indicators, geopolitical events, and market sentiment. This makes staying informed and responsive to global news a critical aspect of successful forex trading.

Forex Trading Strategies and MT4

Developing a robust forex trading strategy is essential for leveraging the opportunities in this dynamic market. MT4 facilitates a range of strategies:

- Day Trading: This involves short-term trading, focusing on daily market movements. MT4’s real-time data and quick execution capabilities are invaluable for day traders.

- Swing Trading: Targeting medium-term trends, swing traders hold positions for several days. MT4’s analytical tools help in identifying these trends.

- Position Trading: For those taking a long-term approach, focusing on fundamental market changes, MT4 provides in-depth analysis tools to gauge long-term trends.

Risk Management and Diversification in Forex

Given the inherent volatility of the forex market, effective risk management and diversification are vital:

- Stop-Loss Orders: To limit potential losses, MT4 allows traders to set automatic stop-loss orders, a crucial feature for managing risk.

- Cautious Use of Leverage: While leverage can amplify gains, it also increases the risk of significant losses. MT4 users must employ leverage cautiously and understand its implications fully.

- Continuous Market Analysis: Staying updated with market trends and making informed decisions is critical in forex trading. MT4’s comprehensive market analysis tools aid in this ongoing process.

The Growing Importance of Technology in Forex

Technological advancements have revolutionized forex trading. Platforms like MT4 are at the forefront of this transformation, offering features that significantly enhance trading strategies:

- Advanced Charting Tools: MT4 provides detailed market analysis capabilities with advanced charting tools. These tools allow traders to visualize market trends and patterns, which are essential for making informed trading decisions.

- Diverse Technical Indicators: A wide array of technical indicators available on MT4 helps traders identify potential trading opportunities by analyzing market trends and price movements.

- Automated Trading: MT4’s capability for automated trading using Expert Advisors (EAs) allows traders to implement and execute trading strategies automatically, saving time and potentially increasing efficiency.

Setting Up an MT4 Account

The process of setting up an MT4 account involves selecting a forex broker and familiarizing oneself with the platform’s features:

Broker Selection Checklist:

- Reliability and Security: It’s crucial to choose a broker with a strong track record and robust security measures.

- Trading Costs: Understanding the broker’s fee structures and commission rates is essential to managing trading expenses effectively.

- Support and Resources: Opt for brokers that offer robust customer support and educational resources to aid in your trading journey.

Forex Market Facts and Figures

The table below provides a snapshot of key facts and figures of the forex market:

| Factor | Description |

| Daily Trading Volume (2022) | Over $7.5 trillion, indicating the market’s vast size and liquidity. |

| Major Trading Centers | London, New York, and Tokyo, where a significant portion of forex trading takes place. |

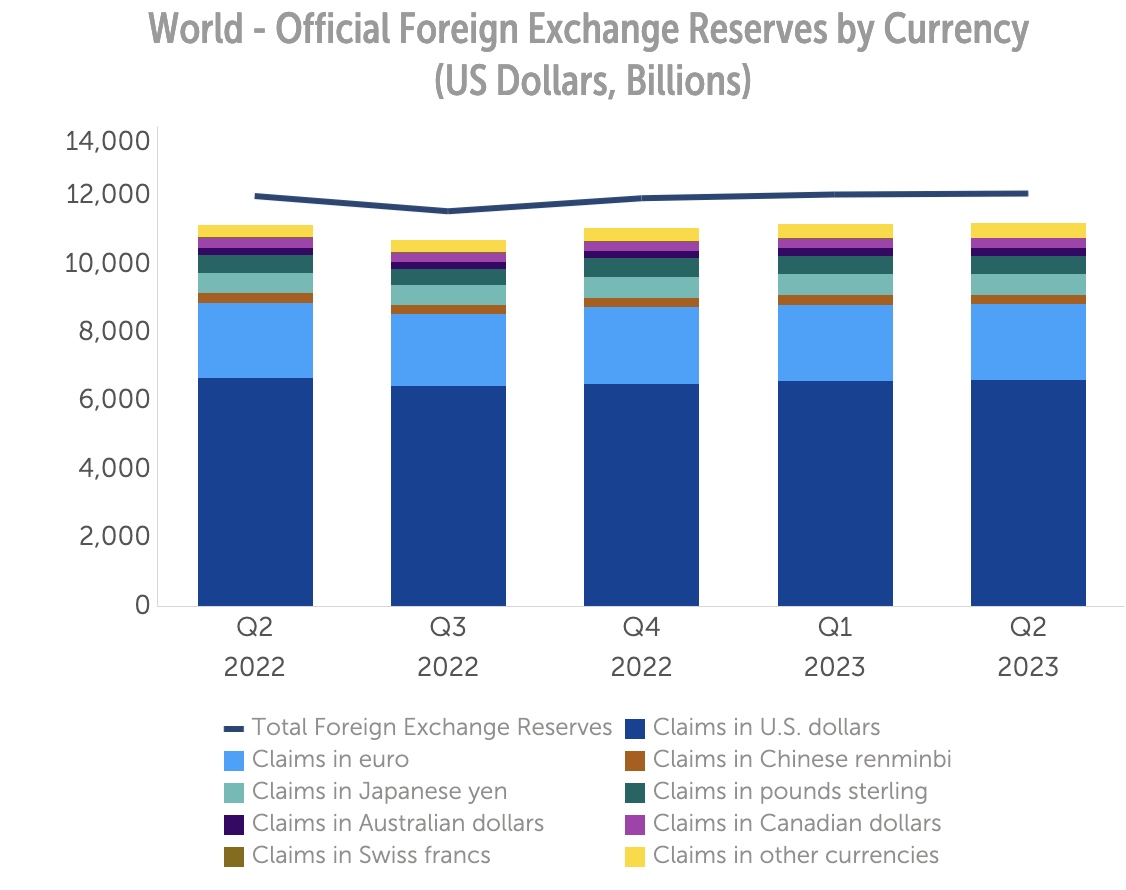

| Most Traded Currencies | USD, EUR, and JPY, due to their global economic significance. |

| Popular Currency Pairs | EUR/USD, GBP/USD, USD/JPY, commonly traded for their stability and liquidity. |

| Market Operation Hours | 24 hours a day, 5 days a week, offering continuous trading opportunities. |

| Key Market Influencers | Central bank policies, economic indicators, and global events that shape market trends. |

| Trading Shifts (2022) | An increase in bilateral trading and a decline in multilateral platform usage. |

Forex Trading: Risks and Opportunities

Forex trading offers significant opportunities for profit but also comes with inherent risks. Market volatility and the use of leverage can both amplify gains and magnify losses. Therefore, traders need to employ prudent risk management strategies and remain aware of the potential for rapid market shifts.

The future of forex trading is increasingly intertwined with technological advancements. Platforms like MT4 are paving the way for the integration of more sophisticated technologies like artificial intelligence, machine learning, and blockchain. These developments promise to further revolutionize the forex trading landscape, offering more refined tools for market analysis and decision-making.

Conclusion

In conclusion, forex trading, with its vast potential and inherent risks, demands a strategic approach and the right tools. The MT4 platform, with its comprehensive features, remains a cornerstone for successful forex trading. By staying informed, using effective risk management strategies, and leveraging the advanced capabilities of MT4, traders can confidently navigate the complex forex market and harness its opportunities for success.