Many people feel that they need more control over their spending behavior. This is especially because they have, for example, some financial goals in mind that they would like to achieve. However, to be able to really control your spending behavior, it is necessary to draw up a budget. That budget is always determined for a specific period, usually one month.

Despite the fact that many people think that setting a budget in practice is associated with limiting expenditure, the main aim is to manage your expenditure more efficiently. Do you also have ears for this? Would you also like to be able to draw up a personal budget? That is possible by taking into account the 6 simple steps in this article.

1. Collect as much financial documentation as possible

It is impossible to draw up a personal budget without having sufficient financial documentation. The first thing to do is to collect as many papers as possible. This concerns in particular:

- Financial documentation of the bank

- Investment account documentation

- Recent invoices of (fixed) costs

- All information imaginable about recurring costs and income

The first key to creating a personal budget is to create a monthly average. The more information you can gather for this, the more correct that average is. That forms the basis for your personal budget, so it is very important to invest enough time and effort.

2. Make an overview of all income

The second step is to draw up a list that gives a good picture of all income. In principle, this is easiest for people who work in employment. After all, they can simply state their net income on the list.

Do you have extra income from, for example, renting out real estate? In that case, it goes without saying that you must also state that income on the list. Are you working as a (freelance) entrepreneur? In that case, it is possible that your personal income sometimes varies. Then it may be interesting, for example, to calculate the average, monthly income on an annual basis and to include this in your personal financial plan.

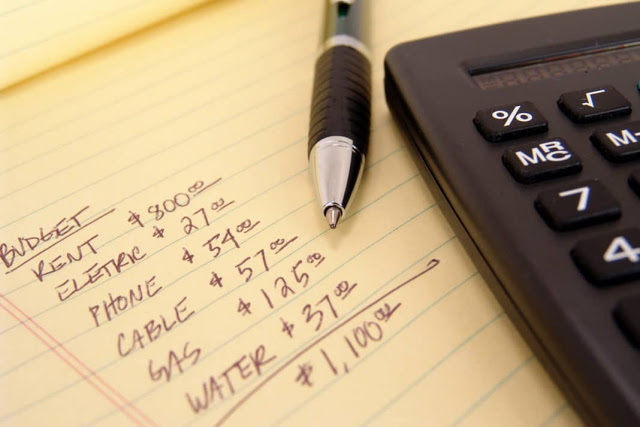

3. Make an overview of all monthly expenses

When you have made an overview of all monthly income, it goes without saying that you should do the same for all expenses you make. The basis for this list is the recurring costs. This not only concerns the rent or payment of the house but also, for example, the costs for the car, the insurance, the groceries you have to do (an average amount is sufficient for this), the possible costs for the children, etc.

It goes without saying that you have to make that overview as complete as possible in order to be able to sketch an optimal picture of the amount you have available monthly to still spend at your leisure.

4. Divide your expenses into two categories: necessary and variable

It is important to keep in mind that not every cost you have to make is a fixed cost. Different costs that you are confronted with therefore have a variable character. The costs that in principle remain the same every month (at least for one year) are in any case:

- The payments of a current mortgage (with fixed interest)

- The payments of a possible car loan

- The fixed costs for water, gas, and electricity

- The fixed costs for internet and/or telephony

In addition to the above, take into account the payments of possible other debts. Don’t forget to consider any credit card debt or else look into getting a credit card consolidation loan from a company like Credible. Besides the fixed costs, it goes without saying that people are also confronted with a number of variable costs. These are costs that can differ month after month. Consider the costs that can be found below:

- The costs for groceries

- The costs of petrol or other fuels

- The cost of gifts

- The cost of holidays and all other additional expenses.

5. Create an overall view of your income and expenses

By following the steps listed above, you will be able to paint a global picture of all income and expenses that you will need to consider monthly. Does this show that your expenses are higher than your income? In that case, it should be clear that there are some (drastic) changes in your spending pattern.

In principle, this is mainly what drawing up a personal budget is for. Please note, as soon as something changes in your financial situation, it goes without saying that you have to adjust your personal budget accordingly.

6. Adjust your expenses in the personal budget

Did you eventually succeed in creating a clear and correct picture of all your income and expenses? In that case, your ultimate goal should actually be to create a perfect balance in this. That said, you also have to take into account, for example, possible amounts you wish to save.

For example, have you decided for yourself that you want to set aside an amount of around 150 euros per month? Then you will of course have to adjust your other expenses accordingly. At first sight, this may not seem easy, but in practice, it is usually possible in various ways to limit your variable costs. This includes:

- More often leave the car in the garage

- Buy products from cheaper brands

- Buy products that are nearing their expiration date and are therefore in the quick sale

- Booking cheaper holidays or postponing a holiday.

Despite the tips in this article, is it still difficult to manage your personal budget? In that case, it is possible to enlist the help of, for example, special personal finance applications.

Over the years, many mobile applications have appeared on the market that can provide significant added value in this area. In any case, it should be clear, would you like to have a certain financial future? Then drawing up a personal budget is definitely worth it.