In the last two decades, many new traders have been looking to get started with Forex Trading. They may start as a complete beginner or after gaining some knowledge. But, if it’s your first time then, here’s a summary of the entire phase.

However, you should bear in mind that you may have to face some risks with Forex trading. You should be careful enough before investing any money. Never trade with money you can’t afford to lose, backtest any strategy you decide upon, trial in love markets on a demo account, and of course, seek out proven courses for forex trading for professional advice.

So, let’s check out the steps and how you can do forex trading when you’re a beginner.

Learn the Basics Thoroughly

Everyone has an approach to learning Forex trading. It is because of this reason that it’s hard to find a comprehensive guide. You may come across many success stories from many parts of the globe. But, the right kind of strategy can only help you progress on your journey to success.

So, when you are eager to proceed with forex trading, you should take up an online course. The most important thing to remember, is that you should never be risking capital that you can’t afford to lose. Seeking out a proven Forex course for beginners, and utilising an education platform that gives you access to global communities and professional advice will ensure you trade within your means.

This is one of the best ways to learn the basics, and understand how to take steps to trading successfully before you even risk any capital.

Be Ready With a Plan

If you wish to succeed with forex trading, you should come up with a plan. This plan should include risk tolerance level, the evaluation criteria, profit goals, and the overall approach. You should get the right education from Forex professionals.

So, produce your plan, set your goals, and then backtest. And backtest again. It’s usually only recommended that once you’re happy with the results of your testing, that you then go live. Sticking to your plan, and backtesting ensures that you’re not just risking your capital and then experiencing a loss that could be detrimental to you.

To gain in-depth knowledge of the trading market and how to come up with a proven trading plan, it’s worth taking up courses for forex trading. Getting advice from experienced Forex professionals will be instrumental in creating a trading plan based on sustainable trading practices.

Use A Demo Account

The importance of using a demo account cannot be overstated. The introduction of electronic trading platforms has allowed many more aspiring Forex traders access into the huge Forex market.

And while these platforms typically allow traders to quickly review the currency market, and perhaps perform a small amount of technical analysis, the best way to thoroughly review your trading plan is to utilize a demo account.

This allows a trader to experience a hands-on demonstration of what it’s like to trade in the Forex market without putting any real capital at risk. These have numerous benefits for traders, though it’s worth mentioning that the mechanics of a demo trade can differ from the live Forex marketing, when you’re using your own capital.

Choose Your Strategy

Within trading, there are Fundamental and Technical traders, which involve very different strategies and approaches to trading. Fundamental analysis involves assessing the economic well-being of a country, and therefore, the currency. Often, these traders use data points to determine the strength of a particular currency.

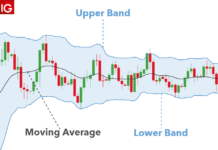

Technical analysis, however, centres on pattern recognition on a price chart. Traders who utilise this approach look for price patterns – like triangles, flags and double bottoms, all of which you’ll come across as you progress in your journey as a trader. Based on this pattern, the entry and exit points are determined. Unlike fundamental traders, technical traders are not as concerned about why something is moving, because the patterns are their signals.

It’s important you’re aware of these strategies, and you identify which approach you’re going to take in order to analyse the market.

Always Be Sure about Your Limits

To be successful with forex trading, you should be aware of how much risk to take. As per your needs, you should always set up an appropriate leverage ratio. Never think about bearing too many risks if you can’t afford to lose.

Seek advice from expert, educational resources such as those from Guerrilla Trading, in order to access and learn from key Forex professionals.

Proceed Slowly and Steadily

It’s more important to stay consistent with forex trading. It would further help to increase the chances of success ahead. It’s good if you have a plan or you have sought out an educational provider, such as the courses available from Guerrilla Trading.

Bottom Line

Finally, you need to comprehend the forex trading strategies completely. These strategies vary among traders as everybody has their style of trading – it’s important to consider the analysis strategy you will adhere to when trading, to further your career as a full-time trader.

Courses on forex trading can undoubtedly help you know more about the strategies that work in the market; especially from providers such as Guerrilla Trading, with their educational resources, you can begin your journey as a forex trader with key insights from leading traders and fellow beginners.

The courses will also take you through the best tactics you could use for forex trading. You would also be able to analyse external sources independently.