Within the realm of Forex trading, the most prized skill that a trader can possess is analyzing trading trends and making informed decisions based on them. Making sense of trends can be a daunting task, as there is information overload when you tread this path. Every day, FX markets generate hoards of financial statistics, percentages, and statistics, and keeping track of everything is very intimidating. Before unraveling the best ways to analyze FX trends, let’s understand what trends are.

What Are Forex Trends?

FX trends are basically a general direction of the trading market or an asset price. They have different time periods, and are premised on the general trajectory of market confidence. If the financial regulatory body of governments has made a positive intervention, then trends can be long term.

However, a vast majority of forex trends are fleeting, where they last from a short to intermediate length. In the context of an effective trading strategy, the best practice is to trade with trends. The most important thing to keep in mind is that if a trend is moving upwards, a person exercises caution and makes trading decisions before the trend moves in the complete opposite direction.

Forex trading has diversified its portfolio, where modern forms of currencies as initial buy-ins, such as cryptocurrencies are also acceptable. If you are looking for the best crypto forex brokers then those at FX-List.com/crypto-forex-brokers can be highly trustworthy and dependable.

There are three types of FX trends: upwards, downwards and sideways. For example, if the USD trend is moving upwards, the currency is increasing in value. The same principle can be applied to downward and sideways trends, where a currency depreciates in value and remains relatively stagnant respectively. Knowing this can be of instrumental value as it serves as the foundation of successful trading decisions- those that make you a fortune.

Making the right forex decisions requires painstaking analysis of trends, and here we have explained two dimensions of analysis that can help you make informed trading decisions, and keep ahead of speculative losses.

Fundamental Analysis of Trends

Fundamental analysis of FX trends factors in fundamental statistics. These include the most vital economic indicators of a country such as its GDP, inflation rate, economic growth activity, and manufacturing sector. Basically, this analysis is based on the relative economic prominence of a country on the global stage.

As currencies are backed by institutional guarantees of the economy, while carrying out fundamental analysis, a person evaluates the potential effect of geopolitical and economic events on the currency.

The question then becomes: how to predict trends using fundamental analysis? For this, seasoned economists and financial experts have crafted economic calendars that make predictions for different currencies. These predictions factor in the geopolitical and economic climate. For example, if a central bank makes a positive economic announcement, traders move to make FX and make the most of it.

You should make sure to stay informed with some important economic indicators such as flux in interest rates, employment percentage, annual budget and GDP. These factors affect the quality of an analysis.

Technical Analysis

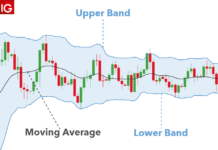

Economic history is like a dialectic: it repeats certain patterns after a cyclical period and Technical Analysis of FX trends makes use of this fact. In a nutshell, the technical analysis predicts future price changes and fluctuations on the basis of evaluating financial statistics of the past. In particular, price points and data is examined thoroughly. Most FX trends and their visual charts are analogous to past trends.

Experienced traders make everyday predictions on the basis of technical analysis, where the see if any current trend can be attributed to a major FX event of the past. The central belief is that the ups-and-downs of price are not arbitrary, rather are motivated by external events that have also happened in the past. While technical analysis seems simple, but it involves a fastidious examination of the history of forex trading.

The easiest way to start is to accustom yourself to the consumption of financial data. This includes volumes of bar charts, histograms, and price charts. You should identify which traders made the trade at the right time, where they benefited from an upward trend, and what was the perfect time to exit, before incurring a loss.