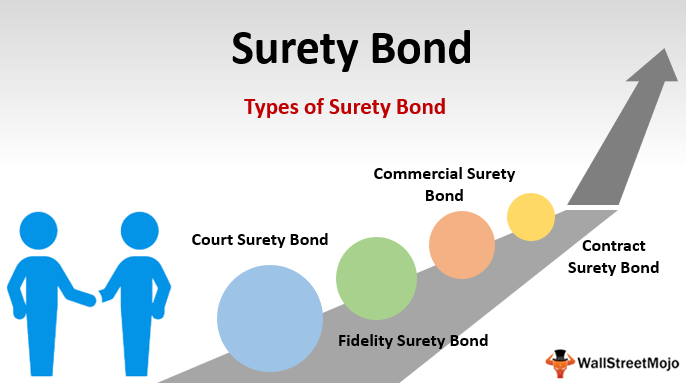

There are different types of surety bonds, and it appears there’s no legal or official way to put them into various categories. To help you understand these bonds better, it’s best to classify them into different categories. These categories include judicial bonds, contract bonds, commercial bonds, and probate court bonds.

What’s a surety bond? It is a contract between three different parties, including surety, principal, and the obligee (the entity that requires the bond). The surety offers a financial guarantee to the obligee that the auto dealer (the principal) will act ethically and in accordance with the requirements established by the bond.

To determine the specific type of surety bond you need, you need to know a thing or two about the following types of surety bonds.

1. Probate court surety bonds

Have you ever heard about a fiduciary duty? It is whereby an individual appointed by an executor, trustee, guardian, or administrator in probate proceeding has a specific obligation to execute their duties with loyalty, in good faith, and honesty. A probate bond is also referred to as a fiduciary bond. It guarantees that the administrator, guardian, or executor of an estate will perform their fiduciary duty to the heirs properly.

2. Contract surety bonds

These surety bonds serve as an inducement for the obligee and the principal to enter into a contract. They are usually used in the construction industry. Contract surety bonds come in a few variations such as;

- Bid bonds typically guarantee that a contractor who bids will enter into an agreement once the bid is accepted.

- There are bonds that guarantee that the contractor will work according to the terms of the construction agreement – performance bonds.

- Supply bonds usually guarantee that the construction contractor will pay the subcontractors who supplied the materials.

- Also known as subdivision bonds, improvement bonds are usually required by municipalities, particularly for subdivision developments.

- Maintenance bonds often guarantee that the construction contractor will pay their subcontractors.

3. Judiciary bonds

Also known as court bonds, judicial surety bonds are used in different situations that involve court proceedings. For instance, in criminal lawsuits, there are bail bonds. These bonds aim at securing the appearance of the accused for future court proceedings and trial. Other types of bonds that are classified as judicial bonds include injunction bonds, mechanic’s lien bonds, appeal bonds, and attachment bonds.

4. Commercial surety bonds

This is a general category for different bonds that cannot fit in the three categories mentioned previously. Sometimes, probate court bonds and judicial surety bonds are classified as commercial surety bonds.

Permit and license bonds are required by the governments if certain types of permits or licenses are supposed to be issued. Public official bonds are usually required of most public officials, including judges, government officeholders, and law enforcement officials. Fidelity surety bonds or business service bonds are necessary to protect customers of various businesses from action by the workers of the organization.

As mentioned earlier, there may be many types of surety bonds. Consult with an expert to know the specific type of bond you need.