With overseas markets becoming increasingly accessible, more and more SMEs are having to deal with foreign currency. Whether it’s paying overseas freelancers or ordering inventory, the lack of experience in managing foreign currency is costing businesses around the world. By exploring the comparison of various business fx services, this article will assess the importance of FX services for businesses.

The first step to cost minimization with FX is to use a low-cost FX broker that has a small currency spread, ideally within 1% of the interbank rate. This will help ensure that profit margins aren’t too severely damaged when receiving revenue in foreign currency like many sellers are suffering from on Amazon and other marketplaces. In some cases, it’s obliterating companies with tight gross profit margins.

Whilst this can give companies more power, in that they now can receive their currency in a foreign currency account and exchange the money on their own terms, a lot of companies do not know how to manage this newfound power.

This is because currency markets are difficult at the best of times, but the pandemic has caused unpredictable behavior – particularly with volatility expected to rise again soon. With the rise of cryptocurrency challenging fiat currencies and an unstable and overpriced equities market, FX markets are very difficult not to get scolded by.

This is where FX business services come in. Whilst some FX companies are there solely to facilitate cheap exchange, some are catered towards business FX consultation and management.

An example of when this may come in handy is a British firm receiving some revenue in USD from an American client. The British firm may be tempted to exchange right away because the FX broker is offering a margin of only 0.5%, and with no fees. Yet, an FX broker offering business services will consult you before this transaction.

They will assess your needs on whether this is a good time to exchange, because the USD is currently weak, meaning you may get a better rate down the line. Perhaps they have already locked in a forward contract because you were aware of when this USD revenue was going to be received. Or, they may ask you if you even need to exchange it at all; perhaps you have a future USD payment to make and can store the USD in the FX multi-currency wallet.

Why timing is important

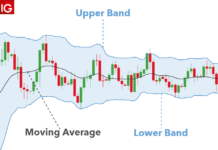

Timing a market accurately is borderline impossible for even the best of traders, let alone those running a non-financial company with little FX experience. However, what FX brokers may be aware of, is if there’s an expected period of volatility on the horizon. For example, political events can cause rapid price changes, and knowing which direction this price change will happen isn’t as important as knowing that the volatility is occurring.

Volatility is something to mitigate where possible, even if you feel confident you’re going to benefit. This is why many FX brokers will advise and facilitate forward contracts on your behalf, which lock in a current, fixed exchange price that will be executed in the future. Thus, you can agree on an FX exchange rate before receiving the revenue from the client. Or, if the company knows it must make a large payment to a supplier next month, a forward contract reduces the currency risk. It’s very easy for a $10,000 payment to become $11,500 in a matter of days because of an unforeseen depreciation.

How FX business services work

Companies such as MoneyCorp and Afex are great examples of how some FX brokers operate. Generally, they have access to the interbank rate, meaning their priority is to facilitate low-cost, safe FX transactions; rates that will far exceed high street banks.

Of course, businesses were in need of risk management, which is why these needs are catered to as well. At the core of such business FX services is a dedicated relationship manager. This is so you can build a personable relationship with the company, giving more bespoke advice as they begin to understand more about your business over time.

Beyond consultation and advice, FX services have branched out into being a source of news and expertise. For example, receiving daily updates via email on the latest market updates with expert insight and analysis. This is certainly a more holistic approach than simply facilitating FX products.

Generally, it is best for SMEs to find an FX provider that has offices within the same country of their operations. This is because customer service is a vital part of the service, and so this becomes a good indicator that they will be working not only in the same time-zone, but have closer contact with customers from this country.

Of course, security over funds becomes incredibly important too, so having offices within the same country of operation can indicate they are fully regulated with trusted domestic regulators, though this isn’t always the case.

Whilst traditionally business foreign exchange services were performed over a landline phone, today it has become much more of a mobile app experience. The majority of transactions can be executed at the click of a button from anywhere in the world. Of course, the telephone is still the number one vehicle to deliver effective consultation with a dedicated relationship manager.